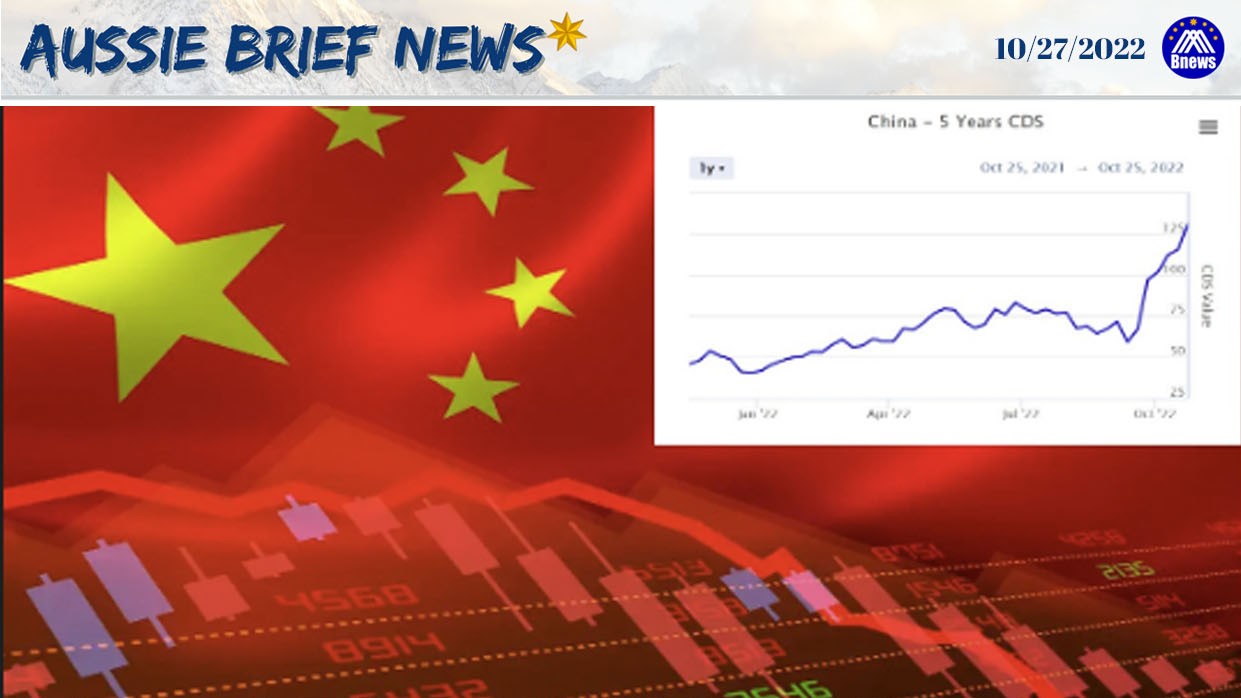

Recently, data from S&P’s Global Market Intelligence showed the cost of insuring exposure to communist China’s sovereign debt rose to its highest level since June 2016, as the country’s assets were sold off rapidly by the global investors in the wake of the 20th National Congress.

In September 2016, National Association of Financial Market Institutional Investors in Communist China released an instruction on Credit Risk Mitigation, which included CRM Agreement (CRMA) and CRM Warrant (CRMW). On the basis of the original CRMA and CRMW, two credit risk mitigation tools, that are Credit Default Swap (CDS) and Credit-linked Notes (CLN) were also added. The so-called CDS is similar to an “insurance policy” against debt default.

The data from S&P showed, the five-year credit default swaps widened 11 basis points (bps) from Friday’s 128 bps. However, the Communist China’s CDS started at 40 bps at the beginning of the year.

Meanwhile, on the 24th, Hong Kong stocks slumped to a 13-year low and the onshore yuan fell to its weakest in nearly 15 years.

Some analysts believe the new leadership team introduced by Xi Jinping at the closing of the 20th National Congress is very likely had sparked the fears among global investors that the economic growth will be sacrificed to ideologically driven policies. .

Aussie Brief News

Go to First Page and Get the Latest News.